March 21, 2016 • Curriculum

It’s no secret that I love doing our taxes. I love the excuse to sit quietly, without interruption for a prolonged period of time. I love the excuse to look back on 2015. I love seeing how the business has grown; I love seeing the results of decisions we made and experiments we ran. I love remembering the causes we supported… And why we chose to support them.

So with that in mind, I wanted to share some of what I observed. I suspect you’ll observe some interesting things in looking back at your own creative business as well…

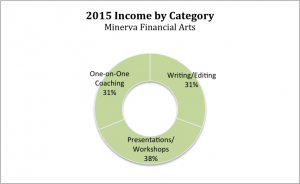

2015 Income

Nope, I’m not going to tell you how much I made. (That’s why you’re here, right? For the juicy data?) Here’s what I will share: I was surprised by how I earned what I earned. My perception was that most of my work and income is derived from presentations and workshops, whether live or online. That was certainly true during 2013 and 2014, but in 2015 that made up about 40% of my income. (Who knew? Apparently not me. At least not in real time.)

Nope, I’m not going to tell you how much I made. (That’s why you’re here, right? For the juicy data?) Here’s what I will share: I was surprised by how I earned what I earned. My perception was that most of my work and income is derived from presentations and workshops, whether live or online. That was certainly true during 2013 and 2014, but in 2015 that made up about 40% of my income. (Who knew? Apparently not me. At least not in real time.)

The rest of the income came from a split (more or less) between one-on-one coaching with artists and writing work. I had pretty substantial growth in both categories during 2015, and the data reflects that.

(By the way, learning something new about my 2015 earnings helped me tweak my 2016 budget. It’s an iterative, imperfect process.)

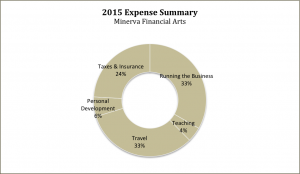

2015 Expenses

In looking back at my expenses, I found a few high-level categories emerged. The biggest one is “Running the Business.” This counts everything from web development to legal support to advertising to postage. The next biggest category is Travel (no surprise), followed by Taxes and Insurance. I had my own Professional Development (maintaining my licenses, my own education) plus a bit devoted to Teaching Expenses (think: Pipe cleaners and play doh).

In looking back at my expenses, I found a few high-level categories emerged. The biggest one is “Running the Business.” This counts everything from web development to legal support to advertising to postage. The next biggest category is Travel (no surprise), followed by Taxes and Insurance. I had my own Professional Development (maintaining my licenses, my own education) plus a bit devoted to Teaching Expenses (think: Pipe cleaners and play doh).

To be fair, these aren’t the categories I use in my system on a day-to-day basis. They don’t have nearly enough detail. I have 28 expense categories and I made use of 27 of them during 2015. (The one I didn’t use is “Other Client Services.” I have no idea what that is supposed to mean, and I didn’t use it during 2014 either. So I deleted it from my 2016 budget.)

These also aren’t the categories from Schedule C. Those categories mirror my own 27 categories more or less, but in some cases, I need more information that will fit within the IRS description. So I add it.

That’s the beauty of keeping your own system. You get to organize it in the way that makes the most sense for the type of work you do and the information you need from your numbers.

Charitable Giving

By far, my favorite part of the tax return is reviewing what we chose to support during 2015. There is something powerful about choosing to support organizations we value. And there is something refreshing about planning our 2016 giving with the same deliberate intention.

In general, we supported education. Whether our support went to colleges or universities for scholarships (Mizzou, OSU, and CCAD), to public institutions that support broad education (NPR, the library system), or other educational initiatives (financial literacy for elementary and secondary children), education was a common theme. It’s also a lifelong pursuit for us, and we believe in making it accessible to anyone who wants it, in whatever form that takes.

We also supported the arts, both via CCAD, the art museum, performing arts groups, and theater companies. Art changes lives. And if our support can make it accessible to someone who otherwise couldn’t or wouldn’t afford a show, that’s a pretty good use of our support.

We supported our community, primarily through health-related giving (OSU’s hospital, Nationwide Children’s Hospital) and repurposing organizations (Habitat for Humanity, Goodwill).

Finally, we supported organizations run by those who matter to us. We gave when friends asked; we said yes when someone shared news of an exciting initiative, we remember times when we’ve been helped. It is this group—which looks like the most delightfully uncategorizable hodgepodge of love—that makes me smile. Each contribution comes with a story, and I am so grateful for every one.