May 16, 2016 • Numbers Nonsense

In this series, based on April’s pricing workshop at Wild Goose Creative, we’re breaking down the equation approach to calculating billable hours… And talking about why the equation approach isn’t enough.

So far, we’ve worked through the equation approach by estimating costs and billable hours to determine a reasonable hourly rate. As a quick refresher, the equation is Costs / Billable Hours, and the answer is Hourly Rate.

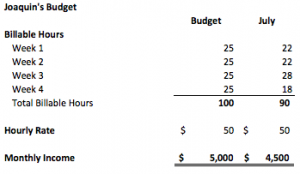

Last week, we looked at Joaquin’s hourly rate:

Costs / Billable Hours = Hourly Rate

$60,000 / 1,200 hours = $50 per hour

Joaquin’s hourly rate is $50.

Joaquin was feeling pretty great about this rate. After all, $50 is way more than minimum wage. And it is low enough that it doesn’t make him feel uncomfortable in talking with clients. Who’s going to argue with a $50 hourly rate?

This week, we focus on three key problems with the equation-only approach to calculating billable hours.

- Problem 1: It only works if the assumptions are right.

- Problem 2: It doesn’t capture efficiencies.

- Problem 3: It ignores market forces.

Problem #1

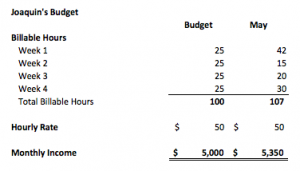

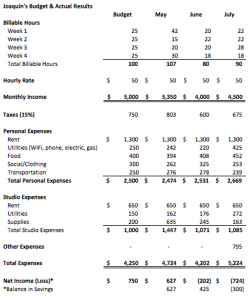

And at first, everything is working just fine. During May, Joaquin’s billings look like this:

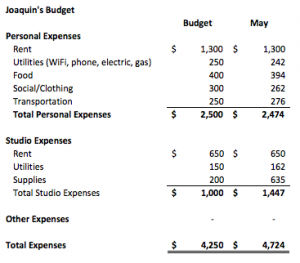

And his expenses for May look like this:

Joaquin made a little bit more than he planned to make (he billed more hours than he expected to bill), and his expenses were a bit higher than he planned (mostly due to supplies). But all in all, it was a good month. He was able to save $627 and pay all his bills.

Clearly his hourly rate is perfect, right?

As long as his assumptions are right, his hourly rate works. As long as his billable hours are pretty close to 100 per month, and as long as his expenses are in line with what he planned, the math works. But what if he has a slow month, either by choice or by chance?

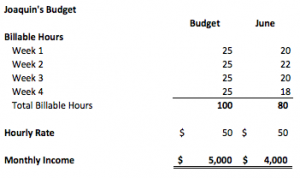

Joaquin’s June billings look like this:

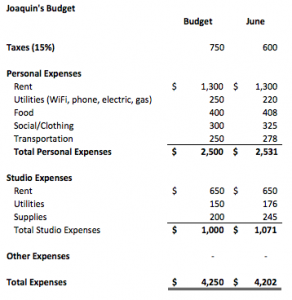

And his June expenses look like this:

He is able to curtail some of his expenses because he realizes his billings will be a bit low, but some expenses aren’t flexible (for example, rent). And to be fair, at some point, he cannot spend less. With 80 hours in billings for June, Joaquin has a net loss for the month of just over $200. (Meaning, he spent $200 more than he earned during June). This isn’t the end of the world. He’s still working with some regularity, and the entire point of having an emergency reserve or savings balance is to help cover months that are less lucrative than we’d like, either by choice (extended vacation) or by chance (fewer projects came to fruition).

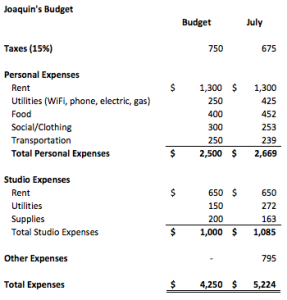

But what if something really bad happens? In July, Joaquin has an unexpected $795 expense. Maybe his car breaks down, maybe he has to travel unexpectedly to care for a sick family member, maybe he has an unexpected visit to the ER (where he realizes he probably should have been paying for health insurance all along). Assuming he is still able to work, his July billings look like this:

But his expenses look like this:

He has another loss for the month, and it is enough to wipe out his remaining savings… And then some. Money doesn’t just appear, so he likely is covering the loss with his credit card, which means additional expenses in future months, both to pay off the balance, and to pay for any interest expense he incurs. So much for savings.

The math approach to calculating an hourly rate only works as long as the assumptions are right-ish. As soon as they aren’t, you either have to work more or charge more to earn enough to break even.

Problem #1: The equation only works if the assumptions are right.

Problem #2 is even worse.

Problem #2

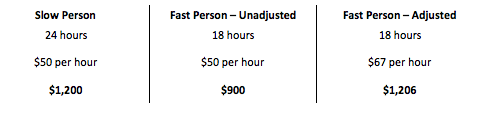

Look at Joaquin’s billings again… Maybe he is billing fewer hours in June and July because he has fewer projects. Or maybe he is billing fewer hours because he is getting better—more efficient—at his tasks. If he planned for a project to take 24 hours, but he can actually complete it in 18 hours, he is essentially being punished for being fast. He is passing his efficiencies on to the client in the form of lower fees ($900 instead of $1,200), which the client loves, but he has to actually work more to maintain his lifestyle. Isn’t the point of being really good at something that we are able to work less, rather than more?

Using the equation approach doesn’t reward efficiencies, at least not for the person who is being efficient. It doesn’t capture the value of those efficiencies.

In theory, a client would be willing to pay a 34% premium ($67 per hour instead of $50 per hour) for the value created by a faster professional. And the faster professional should benefit from that premium, not the client.

Problem #2: The equation-only approach doesn’t capture efficiencies… At least not for the person who is being efficient.

Problem #3

The third problem has to do with everything outside of Joaquin’s control. Whether or not he likes it, there are market forces at work in his industry. What is his competition charging for similar projects? How does he differentiate his work from theirs? What are his customers wiling and able to pay for similar projects? Does he—Joaquin—derive any value from working with certain customers that can or should be captured in an adjustment to his hourly rate?

Problem #3: The equation-only approach doesn’t take into consideration competitors or customers.

These market forces require qualitative analysis on top of the basic quantitative analysis. It isn’t enough for Joaquin to simply calculate an hourly rate and be done with it. Using the equation is a fine—albeit imperfect and borderline risky—starting point, but it doesn’t even begin to capture the entire story of the value Joaquin—or any artists—delivers to a client through his or her creativity.

Recap

Hopefully by now you are comfortable calculating your hourly rate… And even more comfortable discussing the problems with this approach to calculating your hourly rate. Feel free to review Part 1 and Part 2 of this More Than Math series if you’d like a refresher on the calculation.

We promised this would be a three-part series, but there’s still more to cover. In the next two parts, we’ll talk through the other approach to calculating an hourly rate, plus strategies for explaining the rate to clients. (Guess what? You don’t tell them everything.)