May 9, 2016 • Events & Media

Last month, I visited Wild Goose Creative to lead a pricing workshop that started with the “math” answer to the question, “What is your hourly rate?” Then—spoiler alert—we broke down all the reasons why the math answer is incomplete.

In this three-part series we’re breaking down the components of the equation approach to calculating your hourly rate (Parts 1 & 2). Then we’ll talk about why using only this approach is incomplete (Part 3). (If you missed Part 1, feel free to catch up now.)

This week, for Part 2, we’re focusing on billable hours.

Billable Hours

To calculate “billable hours,” figure out how many hours you can reasonably bill to a client during the period of time your equation covers. You’re always working, right? Shouldn’t your billable hours be the number of hours in a week, less the time you sleep?

Not really.

Your billable hours probably aren’t as high as you think they are, because there is a massive disconnect between the number of hours you work (working hours) and the number of hours you can reasonably bill to a client (billable hours). If you aren’t already tracking your time, now is a great time to start. You’ll likely observe that many tasks (updating your website, answering emails, following up with potential clients, having coffee with a mentee or a mentor, etc.) aren’t billable, even though you are working during them. You’ll also likely observe plenty of working tasks that could become billable tasks… If you explain them correctly. Preliminary research and prototyping are great examples. You can incorporate this tie into what you bill your clients as an additional line item (“Research and Preparation”), into a higher hourly rate (+20% for research), or into a flat fee assessment.

For a bit of context, consider the number 2,000. If you bill 40 hours per week to your clients, and you work 50 weeks per year, 2,000 will be your annual billable hours (40 * 50 = 2,000). But this barely includes any non-working time (vacations, holidays), and it definitely doesn’t include time for professional development (classes, residencies, travel). It also assumes that nearly all of your working hours will be billable, which is probably only true if you have quite a bit of help both professionally (like administrative support) and personally (child care, housecleaning, someone to run errands). This figure also assumes nothing will go wrong (unexpected travel, flooded studio space, feline emergency).

If instead, you are able to bill 20 hours per week (roughly half of the time you spend working), and you work 40 weeks per year (with some vacation, travel, and professional development built in), your annual billable hours will be 800 (20 * 40 = 800).

I don’t know what the right answer is for you. I can tell you that about 60% of my time each week is spent on billable tasks, and I can also tell you that I tend to work 50 weeks per year. But you know your circumstances best. In any case, your billable hours probably aren’t as high as you think they are. Plan accordingly.

Equation Example

Let’s look at some numbers for a one-year period. Recall, our equation is:

Costs / Billable Hours = Hourly Rate

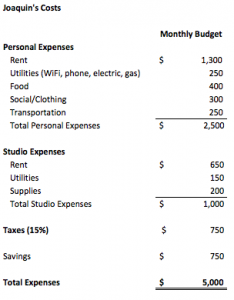

Joaquin calculated his monthly costs to be $5,000. He spends approximately $2,500 to exist as a human (rent, utilities, clothing, food, social), and he spends approximately $1,000 to maintain his studio (rent, utilities, supplies). He also plans to spend $750 in taxes and $750 in savings each month. ($2,500 + $1,000 + $750 + $750 = $5,000)

He estimates he’ll bill approximately 1,200 hours per year, which he calculates based on 25 billable hours per week and 48 weeks per year. (25 * 48 = 1,200)

Joaquin’s equation reads:

Costs / Billable Hours = Hourly Rate

($5,000 per month * 12 months per year) / 1,200 = Hourly Rate

$60,000 / 1,200 hours = $50 per hour

Joaquin’s hourly rate is $50.

Next Up: Part 3

It seems easy, right? $50 is reasonable. Next week, we’ll break down the problems with using (only) the equation approach to calculating billable hours.