February 13, 2017 • Numbers Nonsense

Everyone loves a list, right? Even a list about taxes? I didn’t think so (although BuzzFeed would tell us otherwise).

Nevertheless, this month we’re talking all about taxes, and in that spirit, we thought it would be interesting to share the most common tax questions that come up… along with our answers. As always, these posts are meant to be educational in nature, and not relied upon as tax advice. It’s also worth noting that we have absolutely no scientific data to confirm that these are the most common questions we’re asked. But they certainly feel like the most common questions we’re asked. Enjoy!

1. Is It Deductible?

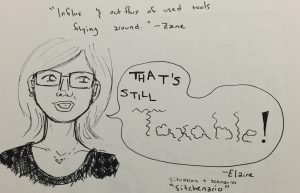

By far, this is the most common question, although the “it” often varies. In fact, these questions are so common, we play a game during most of our live tax workshops called, “Hey Elaine! Is It Deductible?” Think of it like Jeopardy… But with more humor.

The answer is almost always “it depends,” but there are some good ground rules to follow. First, the expense has to be ordinary and necessary, both of which are terms defined by the IRS. Secondly, the expense has to be effectively connected to your trade or business… and the “effectively” part is where many creative people find themselves being a bit too creative. Is it really effectively connected to your trade or business? Or is it a personal expense?

The third ground rule boils down to a gut check. Can you can honestly defend the deduction with a straight face to a hypothetical IRS agent, without extending your credibility beyond belief? This doesn’t guarantee (at all!) that the deduction will hold up. But it does help you assess whether or not you are being too aggressive.

2. Am I Really Running a Business? (And If So, Why Do I Still Have a Day Job?)

The second most common question relates to the idea that “running a business” is a threshold you have to clear. Otherwise, you have a hobby. There are rules of thumb for how to tell if you are running a business, but for me the most compelling part is answering “yes” to three questions. First, do you attempt to run the business in a serious and professional manner? Secondly, do you monitor and track the income and expenses of the business? Third, are you actively seeking to improve the business and your skills in running it? If you can answer yes—with documentation—to those three questions, you are likely running a business.

With respect to the sub-text of that question (“Why do you still have another job?”), the answer can be simple or complex. Perhaps you keep another job because the income from your creative work is unpredictable. Perhaps you keep another job because of the health or retirement benefits. Perhaps you keep another job because you appreciate predictability in your schedule. There are plenty of reasons to keep your day job… And only one of them has to do with not running a business well.

3. What If I Can’t Pay My Taxes?

This one is a bit tougher. Best-case scenario, as you receive income throughout the year, you set a bit aside to pay your eventual tax bill. But if that isn’t the case, you have some options, including asking the IRS for a payment plan. As you consider options, though, don’t forget to consider the cost of each, and as you are considering the cost, make sure to start setting aside money to pay this year’s eventual tax bill.

4. What If I Get Audited?

You might get audited. That’s okay. Often, there is a fairly easy resolution to the audit. Perhaps you listed your social security number incorrectly, or there was a mismatch between the amount of income you reported and the amount that was reported to the IRS. If you receive a letter from the IRS, read it. (That sounds obvious, but you’d be surprised how many people bury the letters in a stack of papers.)

Try to understand exactly what the IRS is telling you or asking you. Then respond accordingly. Believe it or not, the IRS isn’t the enemy. It’s a lovely agency full of people who are just trying to do their best. (And many of them even love art and music.) Find the humanity in the person you are dealing with and seek resolution. The resolution may be as simple as correcting an error. It might be a bit more complicated if you need to provide additional information, documentation, or explanations. Or it might be very complicated if the problem is bigger. But in all cases, find the humanity in the person sitting across from you. I promise it will help. (And by the way, that’s true for non-IRS issues as well.)

5. Why Didn’t I Learn This In School?

Good question. You may have heard a few things here and there in passing. Many of your professors may claim they did in fact tell you these things, but you weren’t ready to really digest them. That’s okay. It’s amazing how a bit of life experience puts all that theoretical learning into context. Imagine if your first art teacher described how to paint, but didn’t let you touch a brush. Imagine if your ballet instructor described how to pirouette, but never allowed you to try it for yourself. Imagine if you heard your favorite sonata played over and over again, but never played it yourself until after graduation. Taxes are kind of the same way. Your professors may have shared stories or tips, but until you actually have to complete the forms and think about your own taxes, it’s hard to really put the information to good use.

Nevertheless, you should have learned more of this in school. We’re working on it. Check out CCAD’s Business & Entrepreneurship offerings and the work of Indiana University’s SNAAP. Call your alma matter and offer to visit as a guest to share your business experiences as they relate to your creativity. Mentor a student. Share your “I wish I had known…” statements with students to help them contextualize the courses outside of their majors. And in the meantime, we’re here to help. Check out our free monthly webinars (a new thing we’re starting this year!) and subscribe to our newsletter for ongoing tips.