April 25, 2016 • Events & Media

Quick – What is your hourly rate?

If you had to think about it too much, or if the answer is too complicated, or if you aren’t entirely sure, it might be time to revisit your pricing model.

Earlier this month, I visited Wild Goose Creative in Columbus to do just that. I led a pricing workshop that started with the “math” answer to the question, “What is your hourly rate?” Then—spoiler alert—we broke down all the reasons why the math answer is incomplete.

Here’s Part 1 of our three-part series on the “math” approach to calculating billable hours…

Part 1: The Equation

At its simplest, the math answer tells us how much you have to earn each hour to cover your costs for a period of time. The equation reads:

Costs / Billable Hours = Hourly Rate

Time Period

First figure out what period of time you’re trying to cover. One year is common, but it involves some assumptions that extend several months into the future. It also assumes that work will flow fairly consistently through the year. If your work is cyclical in nature (for example, a wedding photographer may be busier in June than in January), consider breaking down the hourly rate by quarter instead of by year, or building in some sort of surplus charge during peak seasons.

If you don’t have a lot of historical data for your business, either because your records are, ahem, incomplete or because you are in the early stages of your business, plan for a year and build in an additional contingency. Having an extra 10-20% of wiggle room in your cost assumptions can be very helpful as you discover what the true costs of running your business may be.

Costs

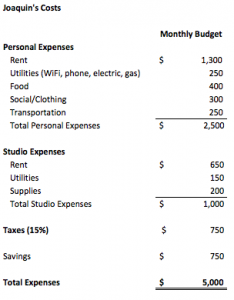

Your “costs” should include both direct and indirect costs, and both personal and professional costs. If you aim to support yourself entirely from your creativity, then the costs your creativity must cover include the costs of running your creative practice, plus your costs to exist as a human, plus some savings, plus some taxes, plus a bit of extra savings for an emergency reserve. (Hint: Your budgets can be super helpful here.) Think of “costs” as “costs you need to cover with your creativity” if that verbiage helps.

If you have additional sources of income, reduce the costs you need to cover by the additional income, assuming it will continue throughout the time period. Be careful though. You may find you become dependent on these additional sources of income because your hourly rate is too low. If your ultimate goal is to eliminate these additional sources of income, calculate your hourly rate without them.

And remember, building in additional contingencies here (for example, an “uncertainty contingency” of 10-20% if your figures are less reliable than you’d like) can give you some much needed wiggle room.

Example

Throughout this series, we’ll be looking at Joaquin’s professional practice as an example to illustrate the points. Joaquin calculates his costs for each month as follows:

Next Up: Billable Hours

Next week, we’ll break down “billable hours” in the context of the equation.