June 29, 2015 • Events & Media

Major transitions in life – geographical moves, job changes, key life milestones, and even personnel changes – cause upheaval, if not outright anxiety. They come with tremendous amounts of uncertainty, and although we occasionally thrive in uncertain situations (adrenalin and such), it’s not exactly the healthiest steady-state existence.

Major transitions in life – geographical moves, job changes, key life milestones, and even personnel changes – cause upheaval, if not outright anxiety. They come with tremendous amounts of uncertainty, and although we occasionally thrive in uncertain situations (adrenalin and such), it’s not exactly the healthiest steady-state existence.

Will I enjoy this new community? Will this relationship last? What will change when the baby is born? What am I supposed to do next?

Wading through these transitions takes a bit of mindfulness, a bit more patience, and an inordinate amount of resources, both time and money.

In fact, that potential resource constraint—the financial kind—is causing Americans to postpone some of the traditional “life milestones,” according to a (very small) survey conducted by the AICPA. In March of 2015, 51% of 1,010 respondents reported putting off “life goals” for financial reasons (compared with 31% in 2007). “Life goals” that have been postponed for purposes of the AICPA’s study included having children (13%), getting married (12%), and having a medical procedure (19%), presumably an optional one.

The financial reasons for the postponement included uncertainty about the future (concern about the economy and employment uncertainty) and difficulty paying existing bills (including credit card debt), not to mention a lack of savings.

I can’t help but think about how the Supreme Court helped remove some of the uncertainty surrounding these issues last week.

In King v. Burwell, the Supreme Court upheld the constitutionality of the subsidies (tax credits under IRC 36B) for healthcare purchased on the federal exchange (in states that chose not to set up their own exchanges). It was only three short years ago this month that the court upheld the constitutionality of the individual mandate under the Affordable Care Act in National Federation of Independent Businesses v. Sebelius.

Perhaps now (finally!) some of the uncertainty surrounding healthcare and insurance options will be mitigated, allowing artists, freelancers, creative entrepreneurs, and any one else without ties to a traditional employer to relax a bit. That surely won’t happen immediately (transitions and all), but I’m optimistic last week’s ruling will help. (I’m really hopeful it will close the conversation once and for all, but I suspect that is a bit of a rosy prediction, even for me.)

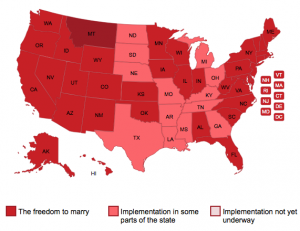

And then in its landmark Obergefell v. Hodges decision, the Supreme Court held “the Fourteenth Amendment requires a State to license a marriage between two people of the same sex and recognize [that] marriage when [it] was lawfully licensed and performed out-of-State.”

I have goosebumps just typing that.

With one sentence, Justice Kennedy, joined in opinion by Justices Ginsburg, Breyer, Sotomayer, and Kagan, eliminated an entire swath of uncertainty for Americans. No longer must spouses wonder how their tax situation may change depending on whether or not their state of residence recognizes their legal marriage. No longer must spouses carry healthcare powers of attorney with them when traveling to a state where their marriage isn’t recognized, for fear of being barred from an intensive care unit. No longer must they list only one parent’s name on a child’s birth certificate, or wonder how their rights may change if they move to a new state.

Yes, much uncertainty was ended last week. And to be sure, whether we’re talking about healthcare or marital status uncertainties, the legal challenges will likely continue in veiled format. (See, for example, legislative responses to Roe v. Wade, like 20-week bans on abortions, excessive regulation to hinder a clinic’s operational feasibility, and heartbeat bills, as potential indicators of the opposition’s strategies.)

And to be sure, this is by no means the final frontier. There will be new challenges to face, some we can identify and some we can’t even fathom yet.

But for today anyway, much uncertainty has ended. And with reduced uncertainty comes quite a bit of financial empowerment. Because, you see, if we know the answers to questions like, “Will I still receive my healthcare subsidy?” or “How will my tax burden change if I become a freelancer instead of an employee?” or “Will my spouse be eligible to receive healthcare under my plan?” figuring out how to allocate our scarce financial resources becomes a more manageable problem to solve.

Happy transitioning. Be kind.