September 6, 2023 • Newsletter

THIS MONTH’S MONEY MESSAGE: SAVE

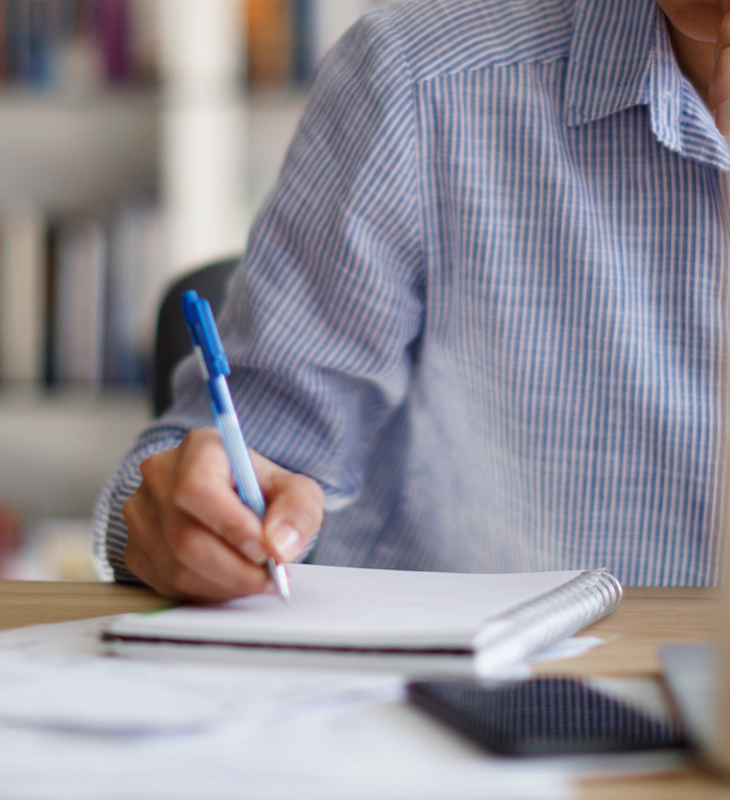

- Extending a trip by two more nights to get a few more chapters written

- Walking away from a gig with an unbearable partner

- Traveling to a nearby city to build your network of gallerists

What is the common thread here? All three scenarios are examples of the freedom that savings can bring.

When we think about saving money, we can tend to view the process defensively. We reluctantly make our deposits, and frame the idea of saving money as a necessary-but-not-so-fun chore to help ward off financial disaster or some unforeseen future problem. And that defensive mindset can be helpful. But it can also be really tough. Disasters aren’t always motivating.

Instead of planning for disasters, we can view saving money as a great tool to unlock more personal and creative freedom. If you have savings – whether for an emergency or a rainy day – you can make more of your decisions without worrying about the immediate financial implications. Essentially, you are using your savings as a way to leverage more control over how you spend your time and energy.

How much freedom do I need?

How much should you save? This is one of the most common questions I get asked when discussing the topic of saving money. There is the tried and true advice about keeping enough on hand to cover expenses for six months, which is fine. But there is plenty of room for flexibility when it comes to a savings amount that is appropriate for you and your goals. Maybe you feel comfortable with enough to cover two or three months. Maybe you feel like you need enough to cover a year. Always keep in mind that these are your goals, so they should be designed to best fit your needs.

Where should I put it?

If your savings account is still paying you 0.05% in interest, it’s time to move some money. Rising interest rates have made savings accounts a much more viable and attractive option, and you can now expect an average of closer to 4.5% with some offers approaching 5.5%. It definitely pays to shop around, especially if you consider an FDIC-insured online bank. Or, if you have reservations about switching to a new bank or credit union, you can always bring a competitor’s offer to your current financial institution, and ask them to match the rate.

If it is time for you to start saving, don’t let perfection get in your way. With higher interest rates, even small deposits can add up over time. Progress toward savings is still progress. Every dollar saved helps you move towards a life with more financial freedom.

As you prepare this month, here are some things to know, do, and believe:

Know: High interest rates help savers.

Take advantage of higher interest rates to make your savings dollars go further. Shop around for the best rate, and ask your bank or credit union to match a competitor’s offer.

Do: Make active efforts to save.

Automatic transfers help here! Think about setting up your bank account to automatically transfer a percentage of whatever you deposit to a high-yield savings account (especially if it is one you don’t check quite as often). Small, recurring transfers can help your savings grow more painlessly over time.

Believe: If you commit to save for your future self, the savings will grow. Saving money is not just about defense, but also about empowering your future goals and dreams.

And it’s something you can start doing anytime – even if you are older, even if you’ve never done it before, and even if you are rebuilding savings you’ve used up.

WHAT WE’RE DOING

This month, Elaine is leading a workshop at the Tamarack Foundation’s Parkersburg Piccalilli Art Conference in Parkersburg, West Virginia on September 14th & 15th. Learn more about the conference and register here.

WHAT WE’RE TALKING ABOUT

Saving – From setting goals to tracking habits, this month we are talking about savings with clients and reviewing online options to help them maximize those rates.

CREATIVE COACHING (1 HOUR, $125)

If you’d like to chat with me to answer your own questions, feel free to find a time that works with your schedule.

SAVE

Give yourself permission to watch your savings grow this month. Write down what the balance is today, and check in again in October. Odds are, it will go up. Keep me posted.

Until next month…

![]()