July 5, 2022 • Musings

This Month’s Money Message: Measure

It is tough out there. Prices for just about everything – gas, supplies, travel, groceries – are up, and they are up enough that even if you aren’t paying attention, you’re probably feeling a bit strained.

Add those financial stressors to the emotional, health-related, and psychological stressors you’ve been carrying over the past few years, and you may find yourself at a breaking point. (Or another breaking point.)

It’s tough out there.

But here’s what we know: Prices fluctuate, the market goes up and down (it does do both), and making informed, measured, choices, rather than panic-induced reactive ones is almost always a better choice.

In tough times, I love to measure cash. Who am I kidding? I love to measure cash in good times too. But I really love measuring cash in tougher times.

And thankfully, we just passed a beautiful measurement point: June 30, which marks the halfway point of 2022. So take a moment to measure your money as of June 30. (I mean it – This is not one of those hypothetical exercises. Actually do this.)

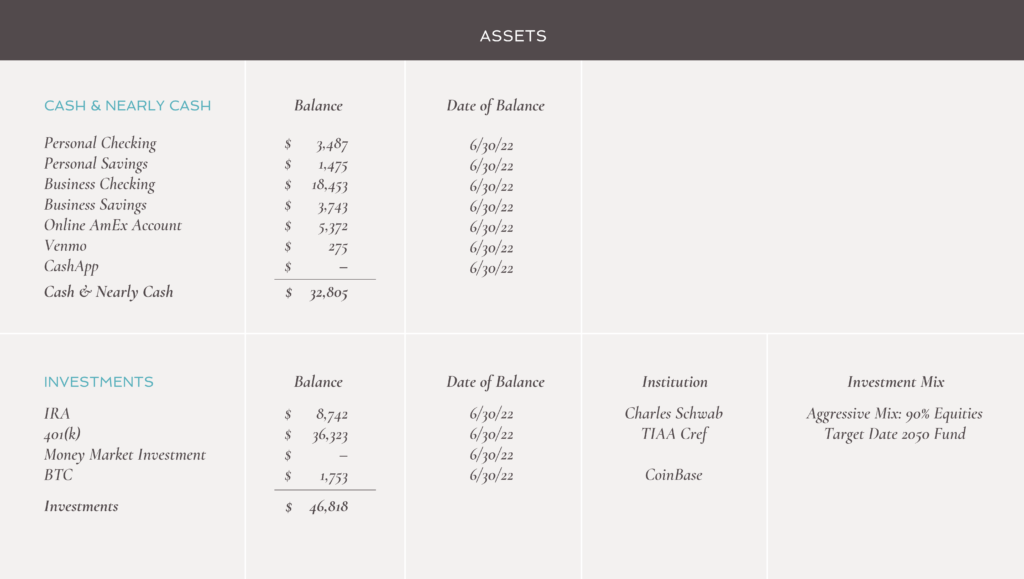

Start with your your bank balances from June 30 (the statements should be ready by now – or at least very close) for your business and personal accounts. Make sure you include them all – even those online accounts you try to forget about or the high-yield accounts through AmEx you secretly keep an eye on. Then add any other near-bank accounts you may have (PayPal balances, Venmo balances, CashApp balances). (While you’re measuring, let’s go ahead and move money from those places into a bank account.)

Then look at your investment accounts: Your IRAs, your 401(k)s or 403(b)s, your money market accounts, and yes, even those crypto accounts. Everything is going to be lower than you may expect it to be. That’s okay. Look at your June 30 balances and add them to your list.

Once you’ve measured, you have some options. You also have some data so you can make measured and informed decisions about those options.

You can note where you may have a bit of cash to spare and think about pre-paying for required expenses you think might be going up in the future (subscriptions, anyone?). You can note whether your cash is enough to cover your expenses for a month (or more) and plan your income accordingly.

You can use this as a benchmark and check in with it monthly to see if the balances are going up or down. You can use this to remind yourself of that time in 2022 that you didn’t panic: You didn’t liquidate your investments, you didn’t lose your mind.

So with that in mind, here are three things to keep in mind this month as you capture your value:

Know: The June 30 balances in your various accounts. Focus on the cash and near-cash accounts, but add the investment accounts as well if you’d like.

Grab all the information and take note of any logins you may need to reset.

Do: Use these numbers to make informed decisions about your funds, whether that is using them to bridge a high-inflation period, using them to pre-pay for future expenses (before they go up), or holding them as a cushion as you cut your current costs.

Do: Use these numbers to make informed decisions about your funds, whether that is using them to bridge a high-inflation period, using them to pre-pay for future expenses (before they go up), or holding them as a cushion as you cut your current costs.

Avoid liquidating your investments unless it is absolutely necessary (or unless you are doing some active tax planning).

Believe: With some measuring, you can choose a measured response.

Believe: With some measuring, you can choose a measured response.

There is no need to panic. Take your time, look at the numbers, and let’s make a plan together.

What We’re Doing

After quite a bit of travel in June things slow down in July giving room for more and more one-on-one conversations and plenty of time for strategy and planning. But don’t worry. There is still a trip to Noblesville to work with Nickel Plate Arts in late July, plus a family vacation in the works.

What We’re Talking About

Expenses are on folks’ minds right now. They are high, they are getting higher, and everyone is looking for strategies. Spend less is the obvious one, although it’s also the hardest. Looking for opportunities to pre-pay expenses that may go up, deferring expenses that will likely go down, and using cash to bridge the gap tend to be strategies we keep exploring with clients.

CREATIVE COACHING (1 HOUR, $125)

If you’d like to chat with me to answer your own questions, feel free to find a time that works with your schedule.

Measure

There are plenty of individuals measuring economy-wide numbers: The price of gas, the consumer price index, the cost of art supplies. Let’s let them do their job. Your job is to measure your own situation – your cash – and use the data to avoid panicking. (Or if the data makes you panic, perhaps it is time for some more stability through a production assistance role?)

Summertime is no time for panic. It’s going to be okay.

Stay measured,

![]()