April 23, 2017 • Numbers Nonsense

If you’ve ever hired a financial planner or read a financial planning article or overheard a financial planner talking at a bar, you probably know how much you “should” have in your emergency reserve fund. It should be enough to fund six to twelve months worth of expenses. (I am certain I’m not telling you anything you don’t know.)

For many creative individuals, that’s where the conversation ends. Funding six months worth of living expenses (half a year!) seems like an insane amount to “have on hand” for a “rainy day.”

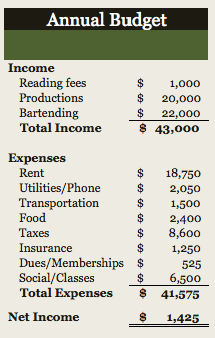

Take this person (a performing artist), for example. This person’s expenses for the year total $41,575, so his emergency reserve goal would be $20,800 (half of that amount). That amount will cover six months (half) of his annual expenses. It’s enough to buy him time.

Take this person (a performing artist), for example. This person’s expenses for the year total $41,575, so his emergency reserve goal would be $20,800 (half of that amount). That amount will cover six months (half) of his annual expenses. It’s enough to buy him time.

Notice there, I said in his checking or savings account. You do not want to invest this little pot of emergency reserve. This emergency reserve needs to be highly accessible to you when and if you need it. You shouldn’t have to worry about liquidating investments if you have an emergency. After you have this small pot of money set aside, then we can talk about more interesting investment options. But not until then. Your emergency reserve fund can’t help you if you can’t access it.

If you are able to save that amount—enough to fund between six and twelve months of your expenses—that’s fantastic. Go nuts. For some of my clients, using this amount as a starting point for a financial goal is perfectly fine. But for other clients, the idea of saving that much money sounds like an insane pipe dream, and the goal actually feels so big, it feels impossible and completely unrealistic. And it actually hinders the saving behavior of some clients because it feels so unattainable.

If that’s how you feel about it, there’s another approach that works well, and by the way, this approach may be better if there are big seasonal fluctuations in your work as well. If you sell work at festivals or perform during a season, or even if your teaching schedule fluctuations on a semester-by-semester basis, you might be better off using this forecasting approach instead of relying on a shortcut approach.

So how do we forecast? We start with the budget (of course).

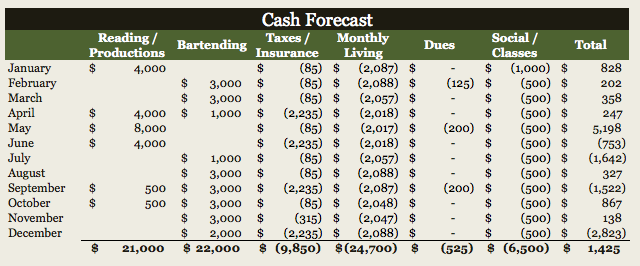

Then we flip the budget. (Note: I didn’t say “flip off” your budget. That’s a different article.) Instead of showing income at the top followed by expenses at the bottom, we show the cash flow detail on a month-by-month basis.

Start with what you know. This person knows he is going to have readings and productions in the spring and early fall, and under his contract, he knows he’ll receive $20,000 for the productions, and he’s hoping for $1,000 for readings. He also knows that this theater company is pretty good about paying, so he expects to get the cash pretty soon after the production.

He slots in his bartending income based on when he thinks he’ll be able to pick up hours at the bar and when he’ll have some downtime from productions.

Do the same exercise with expenses. When will he have to pay expenses throughout the year? For some expenses, this is easy. His rent payment will be the same each month no matter what. He knows that because he has signed a lease. He knows on average his utilities will cost, say $75 per month, but he also knows they tend to be highest in the summer (for air conditioning) and winter (for heat), with lower amounts during the spring and fall. So adjust accordingly. You can see these small adjustments in the “monthly living” column.

But what should you do if they don’t know what these expenses will be? You guess. You don’t randomly guess; you make an educated insightful guess (which we call a predication) based on the best information you have. Your prediction won’t be perfect. It will definitely be wrong in some ways. And that’s okay. It can be enough of a starting point for you to move forward without getting hung up on perfection.

Save your unrealistic expectations for your creative pursuits. Your financial ones don’t have to be perfect.

Take a look at the totals in the far right column. Where are the problem months? June and July will be problematic. September isn’t great, and December is a real problem. Why? Because there isn’t enough cash coming in those months to pay for the expenses. And I agree; that’s a problem. So by looking at your income and expense picture in this way, you can figure out what your emergency reserve number needs to be going into these cash-poor months. Instead of relying on an emergency reserve fund of $21,000 (which might be totally unrealistic for this actor), he should have about $2,400 on hand going into June and July (that’s the sum of his shortfall in those two months), $1,500 or so going into September, and about $2,800 going into December.

If he wanted to look at it on an annual basis, those amounts add up to $6,740. That’s the “real” emergency reserve he needs to have on hand to mitigate any cash flow shortages during the year.

Having an emergency reserve fund of $6,740 is a much more realistic goal, and once he starts working towards it (and accomplishes it!), then he can increase the goal accordingly.

Need Help?

This cash flow forecast trick starts with a budget. If you need a bit of help with yours, check out Budgeting Basics, our online, self-study course. The final assignment is a real budget you share with us for feedback. It’s really fun. We promise.

Budgeting Basics