January 23, 2017 • Musings

An article from the National Endowment for Financial Education came across my desk today. It was titled, “How People Need to Rethink Emergency-Savings Funds,” and I was thrilled. Of course we need to re-think emergency reserve funds. And of course people *know* they should save more… but often don’t. And of course that’s a problem.

When there is a gap between what people know they should do (save money) and what they actually do (not save money), teaching them what to do isn’t usually the right answer. The creative individuals I work with know they should try to save money. And they are the most creative and effective individuals I’ve every known when it comes to living frugally. (The trite financial planner’s advice to “make your coffee at home” is so far out of touch with where most creative individuals are, it is laughable.)

That’s what the article got right. It emphasized that small victories (saving a few hundred dollars, for example) are worth celebrating. It described perfectly a common challenge for many people: If you have to use your emergency fund, building it back up feels exponentially harder than saving the first time around.

But you know what else helps? Talking about it. Talking about these financial challenges with a real live person helps. Building a community of support among other like-minded creative individuals to share victories and challenges helps. Drawing upon that support network when things go well, and when the don’t, helps.

It is no secret that the winds of “talking change” are in the air. In his farewell address, President Obama encouraged us all to stop fighting online and reach out and talk to a person. As individuals become activists and activists become more active, strategies like talking to your representatives in Congress have become incredibly effective. So effective, in fact, that the Women’s March in Washington this weekend included chants of the Congressional switchboard phone number. (Did you miss that? It’s 202.225.3121.)

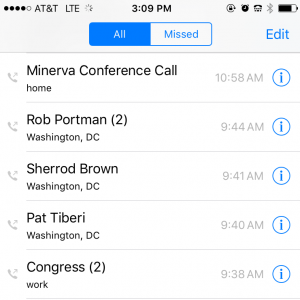

Talking helps. The aid who answered my representative’s phone this morning thanked me for sharing my views on the Affordable Care Act (and why I wished my representative would stop speaking out against it on the floor of the House). The message I left for one of my senators was full of audible talking and good cheer, even as I encouraged him to do the opposite of what he has promised to do. The voicemail box for my other senator, the one whose actions already align well with my own, was full. That’s a lot of talking.

Talking helps.

Talking forces us to slow down. Snark works well in 140 characters and quickie social media posts. It is much harder to respond snarkily in words spoken aloud to another human being.

Talking also helps us express our own thoughts and our own opinions, and that’s where it can be financially beneficial as well. Talking through savings issues — why we struggle to save, why we should bother saving, and how hard it can be — can help us articulate our struggles and our feelings, even if we haven’t completely figured them out yet. And once we can articulate those things, the solutions are often pretty clear.

And that’s worth talking about.

Wanna Talk?

Book a coaching session to talk through your money questions. Talking with creative individuals and helping them solve their money problems is my absolute favorite thing to do.