December 20, 2017 • Musings

So the tax changes are really here. The House and Senate bills have been reconciled and re-approved, so all that is needed is a presidential signature to make the law official. Now that we know what the final bill really entails, we thought it was worth sharing, particularly with those in the creative community we serve. And of course, please consult your own tax experts when it comes to applying any of this.

TLDR Version

There are almost 3,000 words in this post. (I’m sorry.) Skim what you need to skim, focus on what matters to your own situation, and check out the resources at the bottom.

The TLDR takeaway is this: It’s going to be okay. You will still make great work. Your voice will still be heard. Things might be a little complicated in the near future (and beyond), but you’ve been dealing with complications since the beginning of time. A little tax hiccup isn’t going to stop you.

If you want to keep reading (and you should), you may want to have your 2016 tax forms handy… We’ll reference some of the lines so you can see if these changes affect you. (We’ll reference the 2017 tax forms as well, although you likely haven’t completed your 2017 taxes yet.)

Personal Individual Changes

The changes in this section affect your personal income tax form (not necessarily your business tax form). And they affect just about everyone.

Your Income Tax Rate May Change.

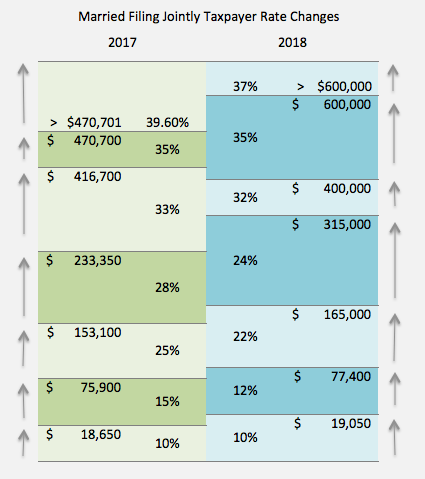

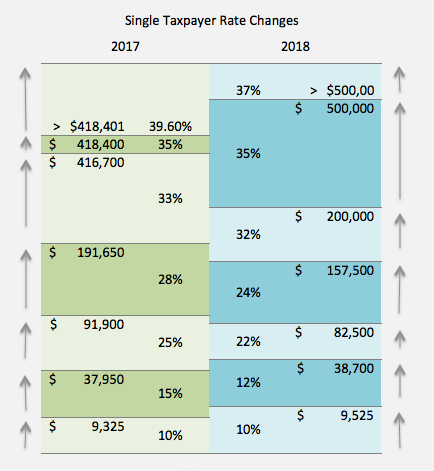

Most of the brackets have changed for 2018. Why does this matter to you? If you make estimated tax payments in 2018, you’ll want to make sure you are using the updated rate to estimate your taxes. (Note that the Social Security and Medicare rates haven’t changed; this is just the income tax rate that has changed.) Don’t plan for too long into the future though… These rates don’t stay in effect after 2025.

The Verdict? With the exception of a few slivers of the population, this is probably good for you in the next few years. Check out the changes in the charts below…

Your Standard Deduction Is Going Up.

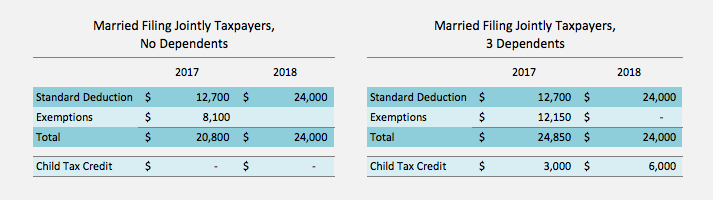

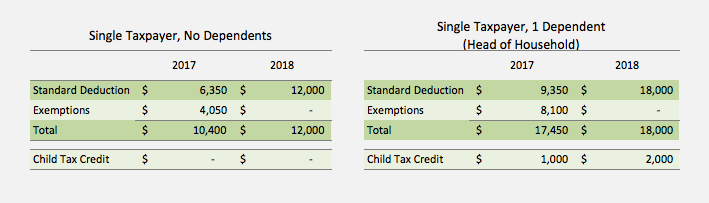

In 2017, if you were a single taxpayer with no dependents, your standard deduction was $6,350 and you got one exemption (for yourself). Next year, you won’t get any exemptions, but your standard deduction is going up to $12,000. If you are married filing jointly with no dependents, your 2017 standard deduction was $12,700 with two exemptions (one for each of you). In 2018 your standard deduction (again, no exemptions) is going up to $24,000. Why does this matter to you? If you have several dependents, this may not be good news, but for the rest of standard-deduction-takers, this probably helps.

Exemptions Are Going Away.

In 2017, you get one “exemption” (worth $4,050) for each person listed on your tax return, plus the standard deduction amount (or your itemized total, if you itemize). In 2018, there are no more exemptions, but the standard deduction is going up. If you don’t have any dependents, this probably doesn’t matter so much to you. The extra standard deduction will cover what you are “losing” by not getting an exemption. But if you have several dependents, you may be losing more than you are gaining. Why does this matter to you? It probably doesn’t. It probably won’t change whether or not you have kids in 2018. (No one I have met plans to have kids for the tax benefits.) But it’s good to know about the change.

The Child Tax Credit Is Going Up.

Even though the exemptions are going away, the child tax credit is going from $1,000 to $2,000. This is very good news. As you start to make more money, the child tax credit starts to go down, and in 2018, the amount of money that triggers this “phase out” goes up. So if you are on the cusp of losing out on the child tax credit (because you make over $100,000 or so), you may benefit from this change.

Break It Down

So how does this break down? It depends. But here are a few summary charts that may help. But remember, credits are different than deductions, so we can’t simply add up the figures below. Credits reduce the tax you owe on a dollar for dollar basis (which is good). Deductions reduce your taxable income (i.e., the amount you owe tax on). The child tax credits don’t replace the exemptions, but they are definitely good news for 2018.

Changes to Schedule A

Check out Schedule A (if you have one). This is where you would have itemized your deductions in 2016. If your Schedule A total is less than your new 2018 standard deduction amount (ish), you may not itemize in 2018. This seems good on its surface, but the standard deduction amounts may not increase as quickly as the expenses they are replacing, so you may find yourself in itemized world again, with some major changes.

State and Local Taxes Will Be Capped.

The first change that affects many of my clients (especially those in high-tax states like New York and California) is that state and local income taxes will be capped at $10,000 starting in 2018. (Look at Line 5a of your own Schedule A from 2016 or 2017—if you have one.) If the amount here is greater than $10,000, you’ll be “losing” some of this deduction. But the higher standard deduction might – might – make up for it.

*Note: Lots of people were talking about prepaying your state and local income taxes for 2018 so you could deduct them on your 2017 Schedule A. That was a great idea, but it was specifically written out of the law. You can’t do it. I’m sorry. However, you can prepay some of your property taxes to get the same benefit. (See Schedule A, Lines 6 and 7.) But you have to own property to do that, which may or may not be the case for you.

Mortgage Interest Deduction Stays.

And speaking of owning property, if you do own a home, you can still deduct the interest you pay on your mortgage, as long as your home loan is less than $750,000. (In 2017, this limit was $1,000,000.) See Schedule A, Line 10 for your own amount last year. This change may really help those in expensive real estate markets, where an apartment for $800,000 isn’t uncommon (or a mansion).

Medical Expense Deductions Stay.

Currently, qualified medical expenses must exceed 10% of your adjusted gross income to be deductible on Schedule A. (It’s on Lines 1-3 of Schedule A if you are curious.) For 2018, qualified medical expenses must exceed 7.5% of your adjusted gross income. So this is good news if you have high medical expenses: You’ll likely be able to deduct more of them. (The bad news of course, is that you had high medical expenses. I hope everything is okay.)

Charitable Giving Deductions Stay.

Giving to qualified charities is still deductible to you, but you have to itemize your deductions on Schedule A to realize the tax benefit. (This is not a change. See Lines 16 and 17 from Schedule A.) Because fewer people may itemize in 2018, lots of charities are worried this change will affect the amount individuals give in 2018 and beyond. It might… But in my experience, the primary reason people support causes they care about is because they care about the cause. The tax benefit is just a little extra something (which lots of people who take the standard deduction don’t really get to realize). Charities – including and especially arts organizations – should do some messaging around this in 2018 to ward off the (potential) negative fundraising consequences. Fellow tax geek, Brian Mittendorf, talks about this a lot.

No More Deducting Tax Preparation Fees.

To be clear, this is for individual tax preparation fees that you reported on Schedule A, Line 22. If you have professional expenses associated with your business (like filing taxes), those are still deductible to you on Schedule C or Form 1065. It is an ordinary and necessary business expense. (See Line 17 of Schedule C.) But paying someone to complete your individual tax return is no longer deductible. (I’m sorry.) My prediction? Watch for accountants to “throw in” your individual tax return for free while they do your business taxes.

Other Individual Changes

There are some other changes on the individual tax return you should know about…

The Performing Artist Travel Deduction Is Still Allowed.

If you are a performing artist who is paid as an employee of a theater who travels for extended periods of time, you can breathe a sigh of relief. There was talk of repealing the special deduction for travel for performing artists, but luckily, that was just talk. This applies to you if you have a number on Line 24 of your Form 1040. (Note that this is not part of Schedule A. You get this, even if you don’t itemize your deductions.) You get to keep this for 2018, assuming you qualify for it. Phew. To be clear: This is a special deduction for performing artists who are paid as employees. (And there are nuances to this deduction – like that you have to be paid by at least two theaters.) If you are an independent contractor or a freelancer or otherwise run your own business, your travel expenses are reported on Schedule C. And they were never in jeopardy. (Read more about the performing artist travel deduction here.)

Teachers Can Still Deduct $250 Worth of Classroom Supplies.

Qualified educators – those that teach for at least 900 hours per year in a K-12 setting – can still deduct $250 worth of supplies they purchase. (And if you know any teachers, you know they spend way more than $250 on classroom supplies.) This was on Line 23 of your 2016 Form 1040. But this does not apply if you are an adjunct instructor or an employee of a group that provides community education. That work doesn’t make you eligible for the deduction under the tax code. (I’m sorry.) However, if you lead your own workshops as part of your practice, and that income is recorded on Schedule C, the expenses associated with those workshops are deductible to you. You don’t get the “qualified teacher supplies deduction” but you can make use of ordinary and necessary business expense deductions. (But those ordinary and necessary deductions don’t apply to teachers or employees – like adjuncts.) (Read more about this deduction here.)

Moving Expenses Are No Longer Deductible.

Once upon a time (2017) you could deduct qualified moving expenses as long as you met both the time test and the distance test, but that is eliminated under the new tax law. So if you were considering a move and you can make it happen before December 31, your qualified expenses may be deductible to you. But that is probably not your reality. December 31 is only 11 days away. So what can you do? Weigh the costs and benefits of moving carefully and if you are moving for a job, ask your employer to reimburse you for the costs (or kick in to help you cover them). That benefit will be taxable to you, but you may be better off by having the cash.

Student Loan Interest Is Still Deductible.

Some of it anyway. If you’ve already completed your MFA and you are paying off your student loans, you can still deduct interest on those loans up to $2,500. These were reported on Line 33 of your 2016 Form 1040. There was no change to student loan interest deductions in the final bill.

Tuition Waivers Stay.

Planning on going back to school? If you get a tuition waiver from whatever institution you choose, that is not going to be taxable income to you. You still have to figure out how to pay for graduate school, whether through tuition waivers, fellowships, grants, loans, or something else, but your tuition waivers won’t count as taxable income. (That’s really good news.)

The Healthcare Mandate Goes Away.

Starting in 2019 (not 2018), the individual mandate that requires everyone to purchase insurance goes away. Why does this matter to you? If you purchase insurance through the exchange, this may cause your premiums to go up. (One of the features of insurance that makes it “work” is that healthy people – or good drivers – have insurance just like not-so-healthy people – or not-so-good drivers. Insurance is all about balancing risk. And if the overall pool of people is “riskier” the costs go up.) Even if you have insurance through your employer, you may still see higher premiums. This is a big change that may cause enough uncertainty for things to get a little crazy in 2019. But they won’t be crazy yet. They’ll be crazy when you start enrolling for 2019 insurance. Still. It’s probably a good idea to build up your emergency reserve fund a bit more in 2018, knowing that this change is on the horizon. Oh, and you should still keep your insurance. Insurance is good and provides peace of mind. Keep your insurance. But plan for chaos. (And remember, 2019 is a long way away. Things could change before this provision takes effect.)

The Estate Tax Will Affect Fewer Estates.

I hope you don’t die. But if you do, and if the value of your estate is more than $5.5 million or so, this change is good news for you. You won’t be subject to the estate tax until your estate is worth more than $11 million or so. Congratulations. As you can imagine, this is a relatively controversial part of the law, especially given the deficit implications of the law overall.

Business Taxes

If you run a creative business (even if you haven’t formed a separate business entity), there are some changes to your business taxes. But they aren’t nearly as major as the individual tax changes… And these changes may end up helping you.

Schedule C Business Expenses Are The Same.

Most people I work with are sole proprietors or single-member LLCs. That means you file Schedule C to report your business income and expenses, and the net income from your business (income minus ordinary and necessary expenses) flows through to your individual tax return and you pay taxes at the individual rate. (See if you have Schedule C as part of last year’s return.) Nothing crucial is changing on Schedule C. Ordinary and necessary deductions (even travel) are still deductible to you, as long as you are actually engaged in business activity. Continue to document the business purpose of each expense and stay on top of those estimated tax payments (especially with the new individual rates).

There’s a New Pass-Through Business Income Deduction.

What?!?! Starting in 2018, 20% of your business income on Schedule C will be deductible to you. That’s huge. You are basically getting a tax cut on 20% of your business income. (And for most creative people I work with, this is really good news.) If you don’t file Schedule C, but you are still a pass-through entity (like an LLC, a partnership, or an S Corporation), you probably have a Schedule K-1 for this year. (Look for Schedule K-1 or Form 1065 as part of your tax return.) Starting in 2018, 20% of your business income will be deductible to you too. This is amazing. Just like with sole proprietors and single-member LLCs who file Schedule C, you are basically getting a tax cut on your business income. (And for most creative people I work with, this is really good news.)

Corporate Tax Rates Go Down.

If you are organized as a C Corporation (which you probably aren’t), the top tax rate on your C Corporation is going down to 21%, and that is a permanent change (unlike the changes to the individual tax rates, which are not permanent). Although this likely won’t affect you personally, this is one of the controversial aspects of the new tax law. Lots of people don’t think corporations should pay substantially less in tax, and the justification for this change (that corporations will hire more people and the benefits will “trickle down” to all of us) isn’t supported by economic data. Many people believe corporations will take the excess earnings and distribute it to owners, furthering the economic inequality we have experienced over the past few decades. Paul Krugman writes about this regularly in the Times, including in his column last week, so he’s a good person to follow if you want to read more about this. David Brooks touched on it this week too. My take? A lower corporate rate isn’t a terrible thing, but if you really want the benefits to make it to the workers, cutting the employee share of employment taxes is a much better way to do it. But of course, this presents funding issues for Social Security and Medicare, although lifting the cap on earning subject to Social Security helps alleviate this. (See? Taxes are complicated.)

The Bottom Line

It’s going to be okay. Lots of the changes may actually be okay for you and your creative business (at least in the near term), but you would be well advised to take the opportunity to save any excess you think you may have to prepare for the healthcare ramifications in 2019. It’s also a good idea to have a healthy emergency reserve fund on hand. (Probably a bigger fund than you currently have.) The impact of the new tax law on the deficit means we’ll continue having conversations about cutting social safety net programs, like Medicaid, SNAP, and other supportive programs that you may have drawn upon in years past. Prioritize saving your own emergency reserve fund since the future of some of these other programs is uncertain. If you rely on grant funding for your work or fundraising from other sources, know that these may be tighter going forward, so be prepared for that. We can use some creativity in expanding your revenue options to make your overall budget work.

And don’t forget. Creative individuals have more grit and perseverance than just about anyone else I know. You will still make great work. You will still change conversations for the better by shining lights on social issues through your work. It’s going to be okay.

Emerson advised us to follow nature’s example of patience. I think that advice is good when it comes to these tax changes as well. If you’ve made it this far, you clearly have enough patience to skim through almost 3,000 words on taxes. That will serve you well, I promise. And it’s going to be okay.

Resources

There is no shortage of information out there about these changes. Here are a few resources that might be helpful.

- AICPA’s Tax Resource Center

- Tax Policy Center

- Tax Foundation

- American Enterprise Institute

- Americans for the Arts Action Fund’s Summary

- Time’s One Page Summary

- Peter J. Riley’s Arts Tax Info Portal

- Fortune’s Take

- CNN’s Summary for Millenials (Ignore the title.)

And you can always talk to me. Follow this link to book a session. Talking through some of these things can really help. In the meantime, enjoy your week. It’s going to be okay.