September 6, 2022 • Newsletter

This Month’s Money Message: Manage

It’s no secret that your costs have been going up. Supplies, transportation, and especially food are noticeably more expensive right now – even though prices are a bit lower than they were last month.

You are probably noticing the numbers – or at least hearing about them everywhere – and you might find it harder to pay those credit card balances in full. You’re not alone. 53% of cards have an outstanding balance on them, and overall credit card debt is inching upwards again after falling during the pandemic.

So this month, let’s manage your debt. Let’s figure out what you owe, what it is costing you, and what a realistic plan to reduce it might look like. (Let’s embed some self-care in that plan as well… Depending on what is going on in your life, eliminating credit card debt may or may not be your biggest priority. Let’s make a plan that works for you – even if that plan is simply coping with the debt.)

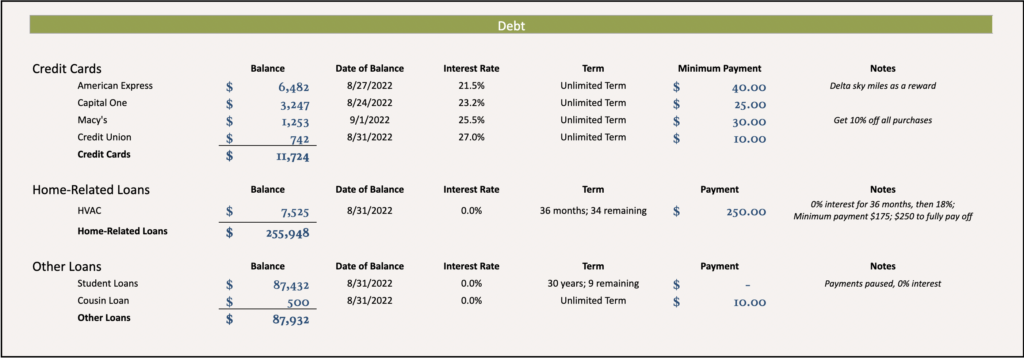

List your debt. All of it. Start with the name of the debt. Then add the current balance (including interest that has accumulated). Then list the interest rate and the payment schedule (if you have one). If there are special things about the debt, makesure to include that as well. Here’s what that process looks like when we do it with clients:

It’s a lot. It takes time. It probably requires pulling statements and dusting off old log-ins. Take the time you need to gather all the data. It may take even longer if you have student loans, given all the changes to repayment pauses and forgiveness that have been in the works lately. Take your time.

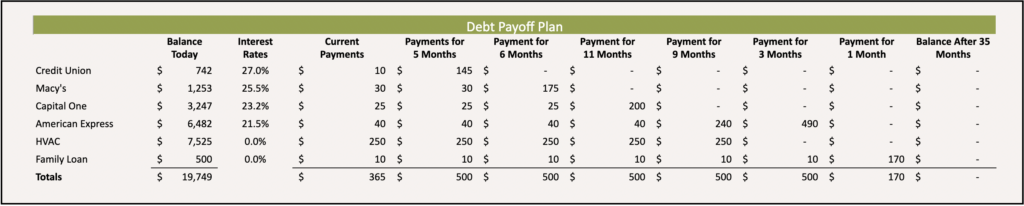

Once you’ve got the information, you can make a plan. The plan will involve some relatively complex math using interest rate formulas, but don’t let those formulas scare you away. Look at what you can afford to put toward the debt each month (realistically) and then figure out how to prioritize those payments over time. The general rule is to prioritize debts with the highest interest rates, but that general rule may or may not work for you. In this example plan, the individual can put $500 toward (non-mortgage) debt each month. This is on top of what they are paying for the rest of their living expenses. Under this plan, the debt will be gone in 35 months.

But the plan will only work if you examine your underlying beliefs. Do you believe it is possible to live without debt? If not, it may be hard to prioritize these payments. For what it is worth, it is possible – even though it may not seem common – and there are ways of getting there that can work for you. We’ll help you find them.

To recap the things to know, do, and believe this month as you manage your debt:

Know: The amount of debt you have, plus the interest rate on each debt.

Do: Make a plan to pay off the debt based on information that works for you and your life.

Believe: Your debt is manageable (even if it doesn’t feel manageable), and you can eliminate it over time.

Believe: Your debt is manageable (even if it doesn’t feel manageable), and you can eliminate it over time.

What We’re Doing

We’re sharpening pencils and opening fresh notebooks this month to visit NYU and NEC (virtually of course). Then, we’re road-tripping to Parkersburg, West Virginia to help artists take over the town (and learn a bit about money along the way).

What We’re Talking About

The back-to-school season must be on everyone’s minds because we are doing a lot of “snapshotting” for folks: Checking in on big picture numbers and seeing where things stand. Not surprisingly, expenses have gone up for most people, which means some creative navigating of the other numbers (earnings, savings, and debt) to keep things on track.

CREATIVE COACHING (1 HOUR, $125)

If you’d like to chat with me to answer your own questions, feel free to find a time that works with your schedule.

Manage

“To manage” can mean to administer, to run, to be in charge of something, or simply to cope. All of those options work when it comes to debt. If you’re feeling up to it, take some time to actively take charge of your debt this month. You’ll be glad you did.

Until next month,

![]()